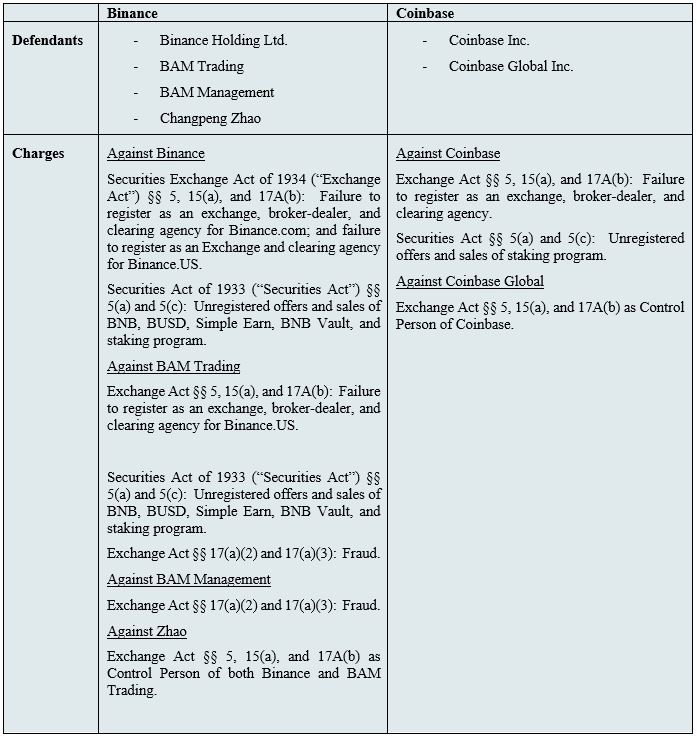

On June 5, 2023, the SEC filed a complaint in the United States District Court for the District of Columbia against Binance, the world’s largest cryptocurrency exchange, and its founder, Changpeng Zhao, known to the world as CZ.

On June 6, 2023, the SEC filed a complaint in the United States District Court for the Southern District of New York against Coinbase, the largest cryptocurrency exchange in the United States. Then, for good measure, a consortium of states sought show cause orders in connection with the company’s staking-as-a-service product.

On June 6, 2023, the SEC also asked the Court in the Binance case for an order requiring, among other things, Binance to repatriate and freeze company assets, and repatriate customer assets.

The complaints allege Binance and Coinbase have operated for years as unregistered securities exchanges, broker-dealers, and clearing agencies. The complaints also allege the unregistered offer and sale of securities, in addition to tokens listed on the exchanges. For Binance, those are BNB, BUSD, “Simple Earn,” “BNB Vault,” and the company’s staking-as-a-service program. For Coinbase, its staking-as-a-service program alone.

The fundamental difference between the two cases is that the SEC alleges Binance also engaged in fraud. The allegations supporting the fraud charge include comingling and diverting billions of dollars in customer assets to CZ-controlled companies, and engaging in manipulative wash trades to create the false appearance of liquidity.

LEGAL TOKENS

The SEC decided to joust with two giants at once. In the case of Binance, it seems, with a certain amount of glee. As the SKrypto blog wrote when Coinbase, Inc. received a Wells notice from the SEC in late March, “There will be no winners here.”

SEC Chair Gary Gensler, sharing his views on Binance in an interview, said the quiet part about how he felt out loud: “It would be as if the New York Stock Exchange is also operating a hedge fund and trading against its customers.… There’s parallels here to the FTX fraud manipulation that we allege against Sam Bankman Fried.” Which gets awkward when you consider Binance’s claims that Gensler should have been recused from the matter based on his personal relationship with CZ in which he gave CZ informal advice on crypto regulation.

On the other hand, Coinbase reports having met with the SEC more than 30 times to discuss a path to registration. Yet, Gurbir S. Grewal, Director of the SEC’s Division of Enforcement, in the press release announcing the action, said, “Coinbase was fully aware of the applicability of the federal securities laws to its business, but deliberately refused to follow them.”

Of course, even the SEC would agree that the securities laws apply only to tokens that are securities, not all tokens, and therein lies the rub: The SEC’s refusal to share its views on the securities law status of specific tokens, except via enforcement actions.

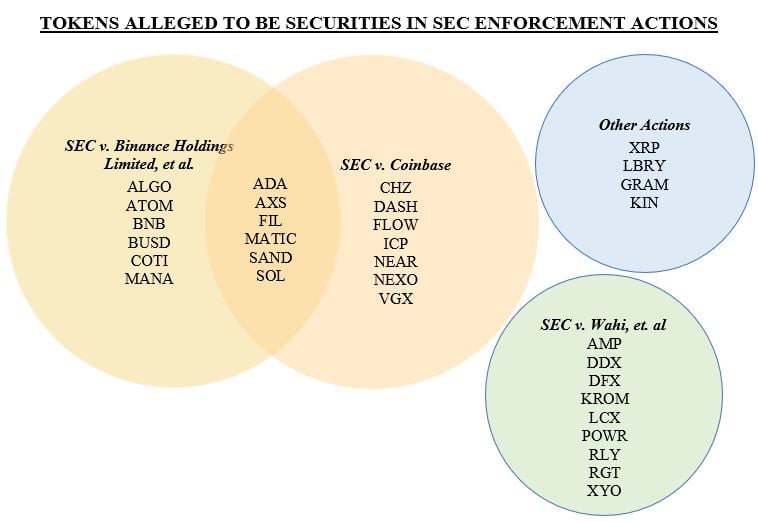

The SEC named specific tokens as securities in their latest actions, including SOL and ADA. Oddly, some of the tokens named in the Binance complaint were not named in the Coinbase complaint even though the same tokens are listed on Coinbase and vice versa.

For those of you keeping track at home, here is a view of the tokens named by the SEC as securities in recent cases:

A good lawyer could make a fair, honest argument that a number of tokens that appear in the chart above are not securities. One could also write the other side of the brief. Pursuing enforcement actions where reasonable minds can differ does not seem the best use of the SEC’s enforcement resources. It also does a disservice to the markets and investors.

Perhaps an act of Congress will clarify crypto regulations. Or perhaps the SEC will create a path to registration and provide some guidance on which of the most widely-held tokens, in its view, are securities outside of enforcement cases. Or we can just wait the better part of a decade while the SEC hashes it out in court.